Blog

Epigenomics AG was established in 1998 by Dr. Alexander Olik to create novel molecular diagnostic techniques based on DNA methylation to detect cancer. The business grew in 2000 when it merged with ORCA Biosciences, a U.S.-based company that specializes in cancer detection via DNA methylation. Through this merger, Epigenomics was able to improve its knowledge of cancer biomarker diagnostics and fortify its position in the US market.

From Epi proColon to Epi proLung: The Evolution of Epigenomics’ Diagnostic Technologies

The first key product developed by Epigenomics, Epi proColon, was designed for the non-invasive detection of colorectal cancer (CRC). The core principle of this test is the detection of the methylated SEPT9 gene in blood samples, utilizing qPCR technology . This test aimed to provide an alternative to traditional diagnostic methods, such as colonoscopy, making it more convenient and less invasive for patients.

The Epi proColon, was the first of its kind to be certified in Europe and received FDA approval in the US. Following the success of Epi proColon, Epi proLung was introduced, targeting the detection of lung cancer. Similar to Epi proColon, this test also relies on DNA methylation as a biomarker to identify the presence of tumor cells in the body.

QPCR technology

The primary technology Epigenomics used to detect methylation changes was qPCR. qPCR stands for quantitative polymerase chain reaction and was utilized by the company to detect DNA methylation levels. The process begins by isolating a sample, such as blood or tissue. A specific region of DNA is then amplified—or “copied”—multiple times using special enzymes, in a process called amplification. During this, a fluorescent dye binds to the DNA. As the number of DNA copies increases, the fluorescence from the dye intensifies, allowing scientists to track the amplification in real time. This signal is used to calculate the amount of the targeted DNA present in the original sample.

Despite the early success with qPCR-based tests like Epi proColon, the company faced growing competition as more advanced technologies, such as Next-Generation Sequencing (NGS), began to dominate the field. This shift in technology would later challenge Epigenomics’ ability to maintain its pioneering status in cancer diagnostics.

Public Listing and Financial Growth

At this stage, Epigenomics held a unique position as a near-pioneer in the field, offering an urgent solution for early cancer detection. Given the increasing demand for innovative diagnostics, it was not surprising when, in 2004, the company went public on the Frankfurt Stock Exchange, raising approximately €41.6 million. This funding enabled Epigenomics to further develop and expand its blood-based cancer diagnostics both in Germany (Berlin) and the US (Seattle).

Limitations of the SEPT9 Methylation Test for Early Colorectal Cancer Detection

In 2017, a systematic review was published in Clin Transl Gastroenterology that examined the results of 25 studies on the use of SEPT9 methylation tests for colorectal cancer (CRC) developed by Epigenomics. Despite the positive findings on the diagnostic value of the tests, in my opinion, this study demonstrated key problems with their use.

The pooled sensitivity, specificity, and AUC (area under the curve) were 0.71, 0.92, and 0.88, respectively. While these results seem promising, the frequency of SEPT9 methylation detection was significantly higher in late-stage cancer than in early stages:

45% in stage I

70% in stage II

76% in stage III

79% in stage IV

This fact reduces the attractiveness of the test as an early diagnostic tool. Detecting cancer in the early stages is crucial because treatment is more effective at this point. Unfortunately, by the time the test shows positive results in later stages, cancer treatment becomes less effective.

The test was more effective in detecting poorly differentiated tumors, which tend to have a worse prognosis. However, it showed a weak ability to detect precancerous conditions, which further reduces its value for screening purposes.

Medicare Reimbursement

In 2019, Epigenomics focused on securing reimbursement for its Epi proColon test from the Centers for Medicare & Medicaid Services (CMS). This was crucial for the product’s commercial success in the U.S. The company applied for a National Coverage Determination (NCD), aiming to ensure Medicare coverage for patient testing.

However, despite positive clinical data, Epigenomics faced financial challenges. These difficulties forced the company to halt the development of its liver cancer test, HCCBloodTest.

In January 2021, CMS issued a negative ruling on the reimbursement of Epi proColon. CMS concluded that the test didn’t meet the required clinical effectiveness standards. This decision hit the company hard financially and clouded its future prospects.

Financial Challenges (2019–2023)

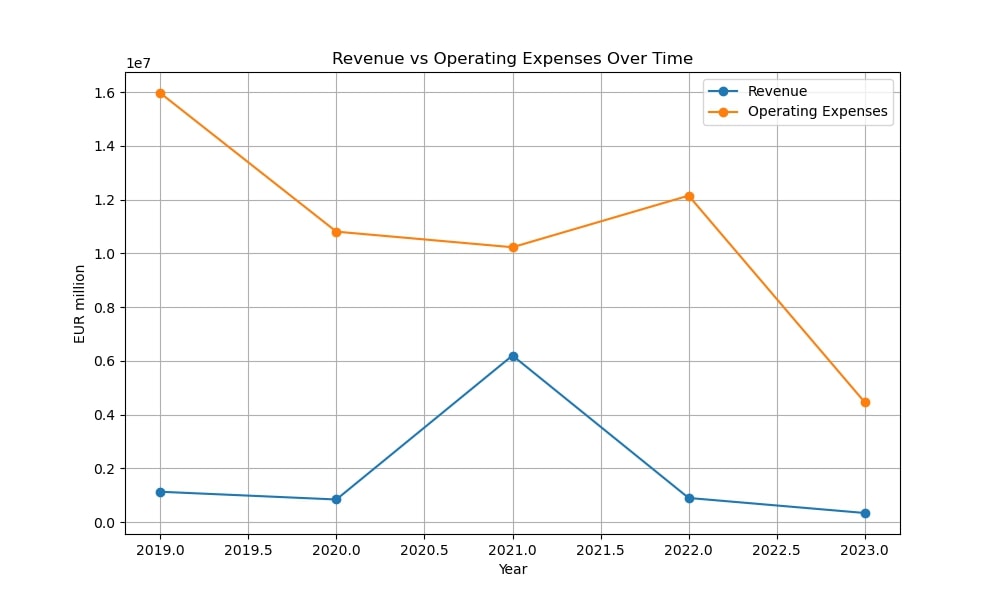

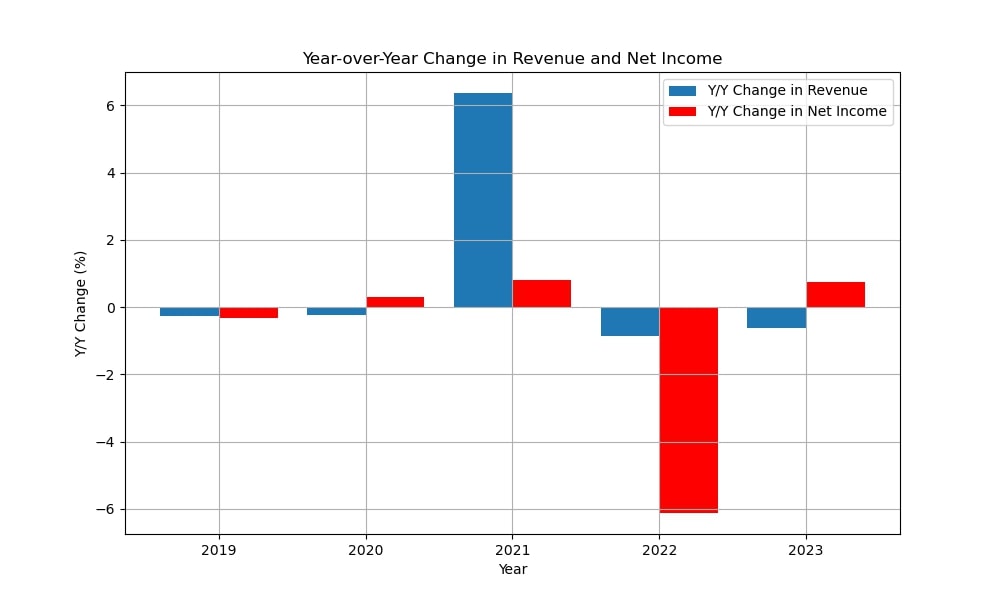

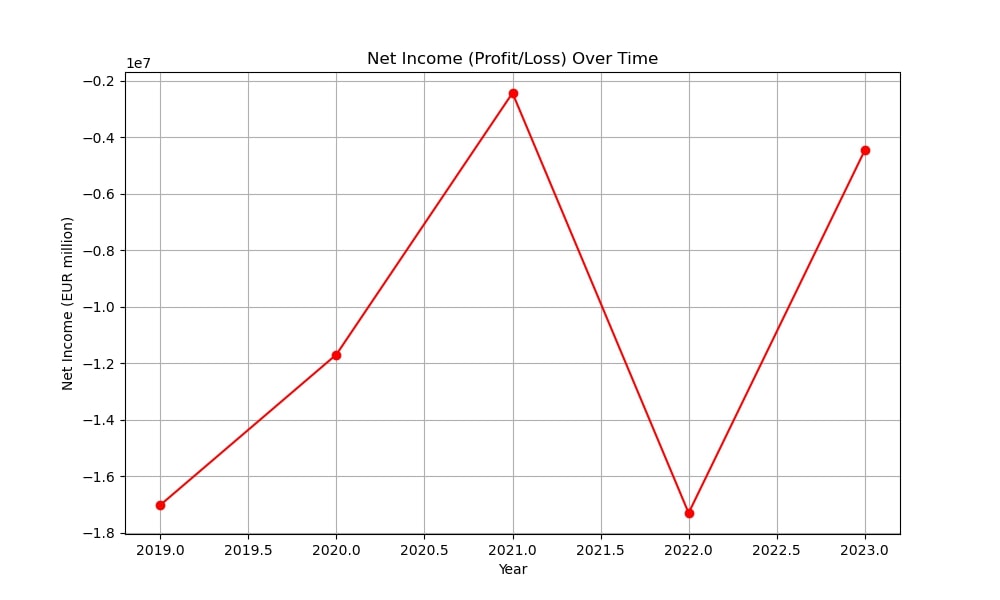

From 2019 to 2023, Epigenomics AG faced serious financial difficulties. The company’s revenues fell from €1.13 million in 2019 to €339,230 in 2023, while operating expenses remained high.

2019: Focus on Medicare Reimbursement

In 2019, Epigenomics concentrated on securing reimbursement for its flagship product, Epi proColon, a blood-based test for colorectal cancer (CRC) screening. The company submitted a National Coverage Determination (NCD) request to the Centers for Medicare & Medicaid Services (CMS). However, despite positive clinical data, financial struggles led to the suspension of the HCCBloodTest for liver cancer detection.

2020: Negative CMS Decision

In early 2021, CMS delivered a negative decision regarding Epi proColon reimbursement, citing inadequate clinical performance. This setback severely impacted the company’s financial situation. Epigenomics responded by developing a next-generation CRC test, Epi proColon “Next-Gen,” aiming to improve clinical performance and meet CMS criteria.

2021: Financial Struggles and Fundraising

Despite financial challenges, Epigenomics managed to raise €22 million through bonds and share issues. However, operating expenses remained high, leading to continued negative net income.

2022: Clinical Trials Halted

By 2022, the company struggled to secure funding to complete clinical trials for Epi proColon “Next-Gen,” leading to a restructuring effort to reduce cash consumption. Net income remained negative throughout this period, with the largest loss of €17.3 million.

2023: Sale of Key Assets

In 2023, Epigenomics sold key assets, including Epi proColon and Epi proColon “Next-Gen,” to New Day Diagnostics, marking a shift from an operational diagnostics company to a holding company managing assets and investments. This was a pivotal moment in the company’s history.

2024: Transition to Holding Company

Following the asset sale, Epigenomics transitioned into a holding company model, continuing to receive milestone and earn-out payments depending on the success of the Epi proColon “Next-Gen” commercialization.

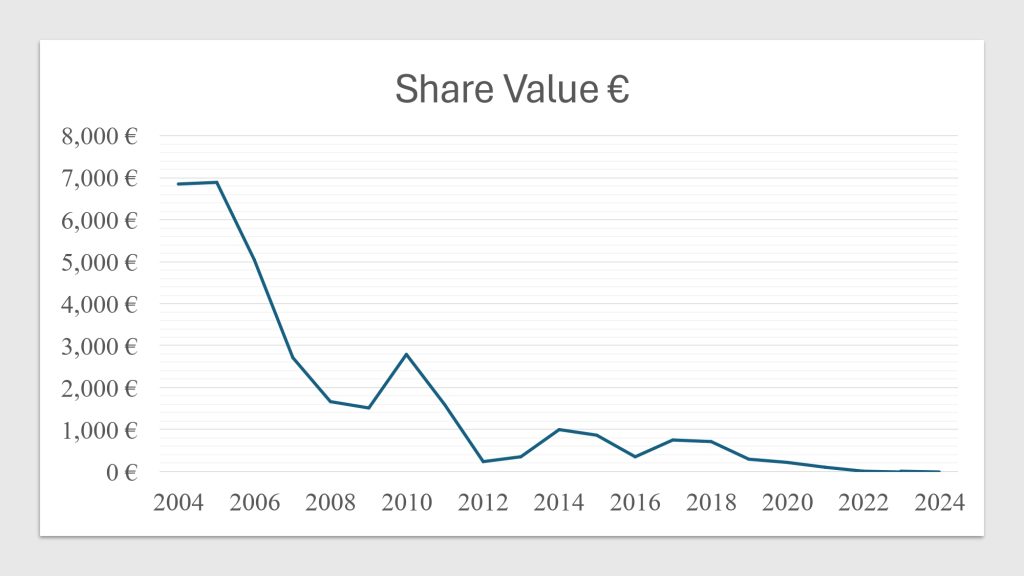

Impact on Share Price

This financial instability and strategic shifts were especially reflected in the company’s share price. When Epigenomics first went public, its shares were trading at just under €7,000. Today, the value has plummeted to less than €1, highlighting the crisis and the loss of investor confidence.

History Repeats Itself: How Epigenomics Failed to Learn from BlackBerry’s Downfall

The situation Epigenomics faced mirrors BlackBerry’s story. BlackBerry, once a leader in pagers, smartphones, and tablets, dominated the market thanks to its innovations. Similarly, Epigenomics was one of the first companies to offer non-invasive cancer diagnostic methods. However, like BlackBerry, they failed to adapt to new market trends. Epigenomics did not keep up with breakthroughs such as Next-Generation Sequencing (NGS), which far surpassed qPCR in sensitivity and capabilities.

This serves as a reminder of how crucial adaptation and innovation are in a fast-changing technological landscape.

Despite early success and substantial investments, Epigenomics faced stiff competition from other players in the cancer diagnostics market. Competitors offered more precise and efficient tests. The company’s failure to evolve its technology became a key reason for its decline.

The Importance of R&D and Monitoring New Technologies

It’s essential to always set aside resources for researching new technologies and keep a close watch on industry shifts. Constantly reading literature and analyzing even the earliest innovations—those just being published in labs—can be the key to success. Companies need to have a budget for research and development (R&D) and always explore new technological opportunities. Today’s cutting-edge technologies, like NGS, could become outdated if even better solutions come along. That’s why companies must stay one step ahead of competitors and always be alert to new developments.

Sources:

- Bioprocess Online

- Google Finance

- Nian J, Sun X, Ming S, Yan C, Ma Y, Feng Y, Yang L, Yu M, Zhang G, Wang X. Diagnostic Accuracy of Methylated SEPT9 for Blood-based Colorectal Cancer Detection: A Systematic Review and Meta-Analysis. Clin Transl Gastroenterol. 2017 Jan 19;8(1):e216. doi: 10.1038/ctg.2016.66. PMID: 28102859; PMCID: PMC5288600.