Blog

In today’s biotech world, science has become incredibly complex and multi-layered. Published results are often taken as gospel, but the reality is that you can’t always rely on the conclusions of papers and studies. Recent research shows alarming statistics: many scientific studies cannot be reproduced. In 2016, a study published in Nature found that most scientists had difficulty reproducing the results of their own and other people’s experiments. In 2024, a study on the topic confirmed that problems with reproducibility persist in the biomedical field and affect the credibility of research.

This is especially important for biotech investors. Investing in a project with an unstable scientific base carries enormous risks. In an environment where many research results are difficult or impossible to reproduce, rigorous scientific verification through due diligence is essential for informed investment decisions.

The Role of Expertise in a World of Complex Data

Preparing to invest in biotech requires a deep understanding not only of the specific science, but also of the reliability of the research methodology. Numerous factors can lead to a research result being non-reproducible: pressure to publish, limited resources to validate experiments, statistical errors, or even bias. In such situations, it is important to have a trusted expert who will conduct a detailed analysis of the data to identify the potential and weaknesses of each project.

Professional analysis helps to identify both the real prospects of the project and possible pitfalls. Such support, like a reliable guide, points the investor to projects that have solid scientific evidence and prospects, and helps to avoid those that do not have a reliable basis.

Support in Making Investment Decisions

In order to invest in biotechnology successfully, one must have faith in its dependability in addition to an interest in science. Careful scientific research is necessary to obtain this level of assurance in a setting where many studies are still non-reproducible. Expert due diligence enables businesses to see past the statistics and distinguish between projects that are merely false prospects and those that have potential.

Having a trustworthy partner who can decipher complicated scientific data aids investors in making wise decisions, conserving money, and preventing losses. Relying on reproducible and effective scientific evidence is crucial when investing in biotechnology, which is a long-term endeavour.

References:

Cobey KD, Ebrahimzadeh S, Page MJ, Thibault RT, Nguyen PY, Abu-Dalfa F, Moher D. Biomedical researchers’ perspectives on the reproducibility of research. PLoS Biol. 2024 Nov 5;22(11):e3002870. doi: 10.1371/journal.pbio.3002870. PMID: 39499707; PMCID: PMC11537370.

Baker, M. 1,500 scientists lift the lid on reproducibility. Nature 533, 452–454 (2016). https://doi.org/10.1038/533452a

Today, hard drives and flash drives are the primary means of storing data. However, in terms of power consumption, longevity, and storage density, these technologies are limited. This, however, could change in the near future. Researchers have focused on DNA as an alternative to silicon-based media. DNA offers a greater density of information storage and is also more tolerant to environmental changes. Technologies that use DNA for data storage have already shown promise, but conventional approaches require DNA synthesis, which increases costs and slows down recording speeds.

The study published in Nature presents a new approach to storing data on DNA. Researchers from the USA and China developed a method that records data without the need for synthesis, using existing nucleic acids and epigenetic modifications as bits of information. This new method combines parallel recording of epigenetic bits (epi-bits) with DNA self-assembly and enzymatic methylation, where modifications such as cytosine methylation act as information bits. These modifications are applied to pre-prepared DNA templates, enabling the creation of a molecular “typewriter.” This makes it a promising solution for mass data storage.

The researchers created a system that allows such marks to be “stamped” onto DNA in large quantities. For example, using this technology, they recorded more than 275,000 bits of data — about 34,000 words of text, with 350 bits per reaction. And this is by using just five DNA templates and a set of 700 “stamps” (or epigenetic bits). The data is read using nanopore sequencing technology, which functions similarly to scanning a book’s pages to determine the precise location and meaning of the markings. Special algorithms have been developed to distinguish up to 240 modification patterns in a single read. This allows for swift and accurate reconstruction of the stored data. An important achievement is that the system can be used by people without specialized laboratory experience, emphasizing the potential for widespread use.

Imagine that you have books with blank pages on your bookcase. You “print” the needed information rapidly by using special stamps with letters and symbols, rather than writing the text by hand on each page. The marks on the DNA serve as letter stamps in this investigation, while the DNA itself serves as a bookshelf. These markers, which are epigenetic changes like methylation, function as “bits” of information, or 1s and 0s.

This technology provides a novel method of data storage that benefits from parallelism, stability, and scalability. Not only does this make data collection and interpretation more efficient, but it can also be used by those without specialized laboratory equipment. This opens up the possibility of wider use and possible incorporation into everyday activities.

Reference:

Zhang, C., Wu, R., Sun, F. et al. Parallel molecular data storage by printing epigenetic bits on DNA. Nature 634, 824–832 (2024). https://doi.org/10.1038/s41586-024-08040-5

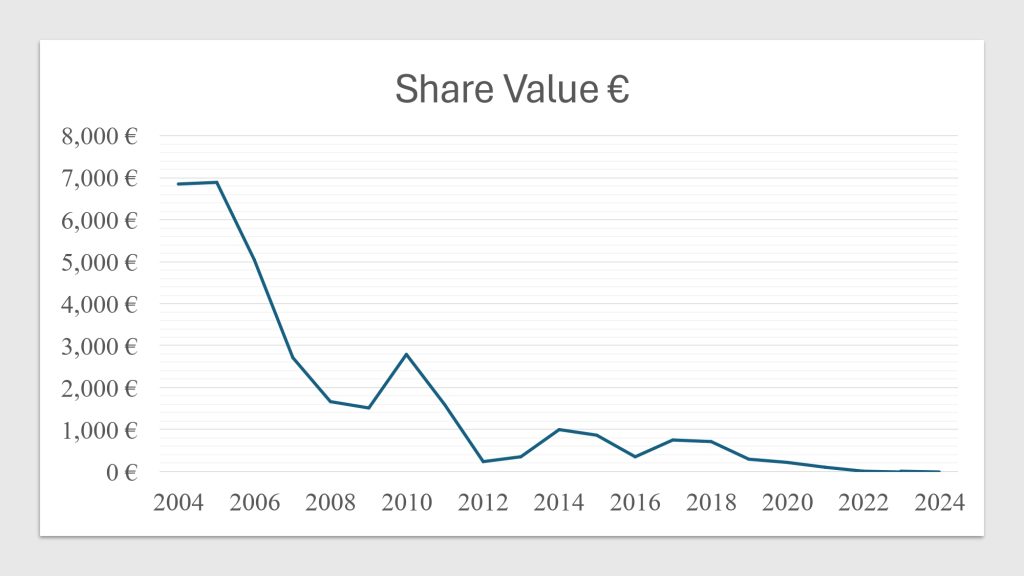

Epigenomics AG was established in 1998 by Dr. Alexander Olik to create novel molecular diagnostic techniques based on DNA methylation to detect cancer. The business grew in 2000 when it merged with ORCA Biosciences, a U.S.-based company that specializes in cancer detection via DNA methylation. Through this merger, Epigenomics was able to improve its knowledge of cancer biomarker diagnostics and fortify its position in the US market.

From Epi proColon to Epi proLung: The Evolution of Epigenomics’ Diagnostic Technologies

The biotech sector has been awash in the news lately, with companies shutting down, venture capitalists becoming increasingly cautious, and the overall market mood looking subdued. But as the saying goes, the darkest night is just before the dawn. And in 2024, there are signs that the sector may finally be starting to recover from its long decline.

An article in Nature Biotechnology titled “Funding Biotech: The Darkest Hour Before the Dawn” discusses the challenges the industry has faced over the past three years and points to emerging trends for recovery.

Three Years of Decline: Why Is Biotech in Crisis?

The biotech sector’s situation began to deteriorate back in 2021 when the COVID-19 boom ended. At that time, biotech companies were literally swimming in cash, raising millions of dollars to develop new drugs and technologies. However, with the end of the pandemic, the funding dried up, and the market began to decline.

The problems were exacerbated by rising interest rates and cautious investors, who now prefer to invest in more stable and safe assets. The public company market is also not conducive to optimism: most biotech stock prices remain low, and new IPOs are almost non-existent.

Light at the End of the Tunnel: Signs of Recovery

Despite all the difficulties, 2024 has brought some positive signs. Large investment firms such as Flagship Pioneering and Foresite Capital have started to create new biotech funds. Successful IPOs such as CNS-focused Rapport Therapeutics have raised significant funds and shown that investors are starting to pay attention to biotech companies again.

In addition, investors are focusing on late-stage projects that can already boast of early clinical results. This helps such companies to raise large sums and make deals with large pharma manufacturers.

The article highlights that the average size of funding rounds has increased over the past six months: venture capitalists prefer to invest in more mature companies with proven teams and interesting developments. This leads to the fact that one successful startup can raise tens of millions of dollars, while less successful projects are forced to close or seek funds on less favourable terms.

New Trends: What Attracts Investors?

In the current environment, investors are actively investing in several hot areas. Among them:

- Immunotherapy and anticancer drugs: Companies working on the creation of antibody-drug conjugates (ADC), radioisotope therapies and drugs for the treatment of oncological diseases remain in the focus of large pharmaceutical companies and venture capitalists.

- Technologies using artificial intelligence: Startups using AI and machine learning to develop new drugs and improve research are also attracting significant investments. For example, in April 2024, Xaira Therapeutics raised $1 billion in early-stage funding.

- Chinese Biotech: Despite political instability and tensions with Western countries, Chinese biotechs are becoming increasingly attractive to foreign investors. This is due to the high rate of innovation and relatively low valuations compared to Western companies.

European Companies: How to Survive in a Funding Shortage?

In Europe, the situation remains difficult. Local capital markets do not have the same depth as in the US, and the number of specialized venture capital funds is limited. As a result, many European startups are forced to either raise funds from public funds or seek strategic partners among corporations.

However, there are also positive examples. Companies like Asgard Therapeutics have managed to raise large funds thanks to the support of corporate venture funds and government programs. European companies are also gradually starting to attract American investors, especially in areas such as artificial intelligence and medical technology.

Is There Hope for an Upswing?

The biotech sector is certainly going through tough times. But, as in any cycle, there is growth after a downturn. If the positive trends continue in 2024 — growth in late-stage funding and the attention of large pharma companies — then biotech companies will be able to emerge from the crisis stronger and more adapted to the new reality.

The most important thing to remember is that even in the most difficult times, some projects and teams find opportunities for growth and development. And today’s situation is not the end but only a stage on the way to a new, more stable and healthy biotech sector.

Reference:

Senior, M. Biotech financing: darkest before the dawn. Nat Biotechnol 42, 1331–1338 (2024). https://doi.org/10.1038/s41587-024-02357-2

Back

Back